How to Find Out How Your 401(k) is Performing

How is your IRA doing? What about the old ones from previous employers?

Did you lose your job? Do you have an IRA from a previous employer? If so, do not lose Your Money!

If you lost your job or you are on furlough, I am so sorry for your job loss; that must be tough. I have been through this myself more than a couple of times. I hope this changes for you sooner than expected.

So, if you are not working, does that mean you will not have any health and disability insurance or life insurance? (We may be able to help you with your health insurance too. We are solution finders.)

What is going to happen to your 401(k)?

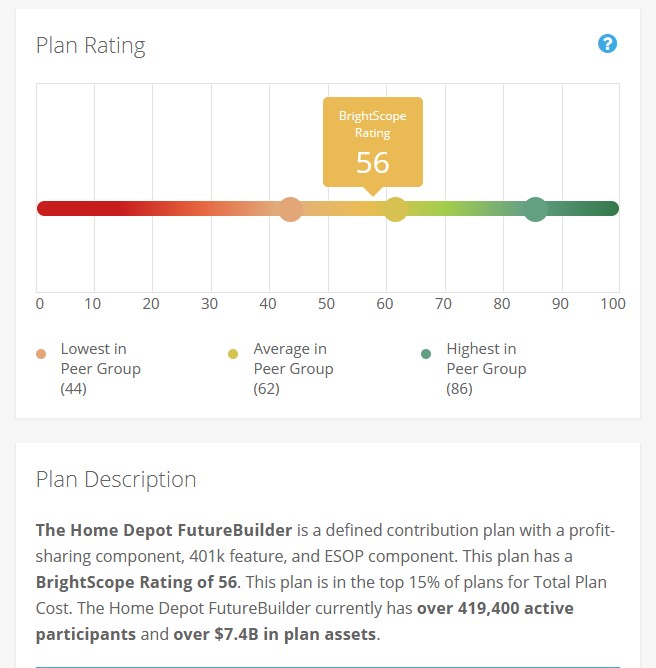

Here is how you can look it up your plan and see how it is doing… Go to: www.brightscope.com

Click on, “Select an Option,” choose, “Research a 401k Plan,” then type in the name of your company, like Home Depot, Ross Stores, or Goldman Sachs.

Here are some Examples

Home Depot, which is an average performer, Ross Stores is a below average and Goldman Sachs is above average, all would have lost your money if you worked there!

Home Depot, a good company to work for, strong and healthy; however their 401K is an average performer. It has a score of 56 from a scale of 1-100, means this is a grade F!

Look how many extra years you would have to work because they lost YOUR money, 14 years!

Ross Stores is a below average,

A score of 47 from a scale of 1-100, means this is a grade F-!

Your would have to work an extra 18 years because they lost YOUR money!

Goldman Sachs, a top notch company to work for is above average with a score of 85, sounds good right?

Your would have to work only an extra 4 years because they lost some of YOUR money!

I could have shown you low performing ones, these are actually the good ones!

Do you think you should keep your money there?

Here is a sad story, I had put in $15,000 to a company sponsored 401K, for over 10 years via my previous employer. This is a major bank in the 90’s. It had matching funds too. I looked it up recently, it as just has over $500 in it now. OMG!!! If it was in a passbook account at less than 1%, I would have a tad over $30,000 in it today. If I had put it in an Index Fund, I would have had over $240,000 in it. That bank, that I put in my blood, sweat and tears into for over a decade lost MY MONEY! Do not let it happen to you!

The 401k Fallout

Since then, it has actually gotten worse! If this happened to you, we can help!

https://www.youtube.com/watch?v=q8C1ZUrYhC0

Did you know you can move YOUR money to a better plan?

We are solution finders and we can search over 300 companies and show you the top plans, and you can choose the best retirement plan for you, one that will NOT lose your money and give you better returns and growth!

Then, if you want, you can roll it over! Then, you are properly protected and ready for your future.

Leave a comment