Debt is a nasty modern convenience that entraps so many of us, more so now than ever before. It is so easy to get a credit card and even more convenient to use them. Then in the process of their uses, we often forget how much was spent, because few will keep track of it. Then suddenly, we are buried in bills and are strangled to pay them off.

Now there is good debt such as a home mortgage or a business loan. Such debt is what is helping you build your future to take from today and build a better tomorrow. Whereas a bad debt, such as credit cards and a store credit shopping spree. Such credit debt will just dig a big hole that you will be paying on for years when those goods are useless and long gone providing no useful means for you. Bad debt is taking money away from your future that you need to live and build upon and stealing it away for pleasure or a perceived need today. Thus, it is the bad debt that is our priority to pay off. Then, we can use the same principles to pay of the good debt.

- First, now is the time to assess your balances, what is coming in and what is going out. This is always the first step I do when I am consulting with a client to help them pay off their debt. You need to see the big picture of what your money is doing.

- Second, STOP the overspending and get control of your budget and know where your money is going. Create and live with, bare-bones budget. In order to get out of debt, you first need to stop getting into debt.

- Third, call your Credit Card companies and change your terms. Yes, you can do that; the worst that can happen is they say no. So, seek to renegotiate and ask for lower interest and sometimes you can do this with other bills. You can also try to get a lower interest credit card and transfer the balances, such has these: https://www.nerdwallet.com/balance-transfer-credit-cards.

- Fourth, pay more than the minimum payment! Below I will give two methods to pay off debt faster, but for the most part, pay more than the minimum.

Now Expedite this! How to Get Out of Debt Faster:

Here are two of the best approaches to pay off debt. One is called the “Snowball” and the other is called the “Avalanche.” These work by accelerating the payoff by changing the order of your debts. Then, you will save hundreds to thousands of dollars in interest payments and reduce the time it takes to pay off the debt significantly. Sometimes cutting by years. And there is considerable debate among Financial Planners which is best. Let’s look at them:

The Snowball Debt Payment method is a great strategy where you pay off the debt in order of smallest to largest. You take the smallest balance, pay it off as fast as you can, with as much as you can, then take that amount of payment and apply it to the next smallest account and so forth, until you are all done. Such as if you have an extra $500 a month because you decided to make your own coffee instead of going to the that coffee place, ad packing your own lunch for work, put that money to work to pay it off. You will be gaining momentum as you pay off one credit card balance at a time.

For example:

- Discover, $1,300, 24.49%, the smallest balance.

- Visa, $3,200, 19.8%, the second smallest balance.

- MasterCard, $5,500, 12.5%, the third smallest balance.

- Student loan, $9,900, 6%, the fourth smallest balance.

- Car loan, $12,800, 7%, the highest balance.

How it works, by making the minimum on the larger balances and pay more to the smaller balances one at a time so you create synergy. The math expiates the payoff in that way faster than just a little more on each one. And, when you are paying off those lower balance credit cards or loans it will progressively kill off more bad debt in the least amount of time. This Snowball Method works best if you have several balances and or when you have borrowed money from friends and family. This is also motivating because you will see greater progress.

The Debt Avalanche Method, also known as Debt Stacking works by first making a list of all your debts like above except sorted by interest rate, such as highest to lowest.

For example:

- Discover, $1,300, 24.49%, highest interest rate.

- Visa, $3,200, 19.8%, second-highest interest rate.

- MasterCard, $5,500, 12.5%, third-highest interest rate.

- Car loan, $12,800, 7%, fourth-highest interest rate.

- Student loan, $9,900, 6%, lowest interest rate.

Thus, you make the minimum payment on all your cards and loans, except the Discover Card, $1,300, 24.49%, the one with the greatest interest. Then you pay all that you can until that balance is paid off, then do so for the next on the list until you are debt free.

Which is the best one?

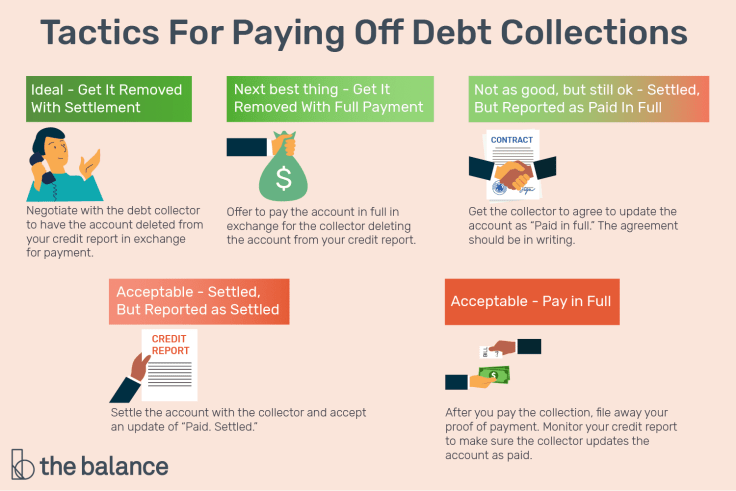

The best one is the one you use! The real difference between the Snowball and Avalanche methods is the order in which you pay off them off. They both work well. With the debt Snowball, you pay the smallest debt first and then work your way through, whatever the interest rate is. It works best when you have several credit card bills of various amounts. With the debt Avalanche method, you pay the max you can toward the debt with the highest interest rate first. This works best with larger amounts of debt with high interest rates. The important point is pick one and your debt will be going away faster than just a taking the max you can pay and spreading them out on all of them! However, if you have a high-interest card with a large balance, then you should certainly pay that one off first. In addition, pay off any debt that is in collections, payday loans, and certain medical first, and renegotiate them too.

You can do this, do not be overwhelmed or stress or allow this to affect your relationships! Paying off debt can be hard for many to do, because we got used to just spending, but consider the benefits of your financial freedom.

If your debt is over fifteen thousand dollars and you need help; I work with companies that will help you!

Dr. Richard Krejcir is a licensed and experienced Financial Consultant with over thirty years of experience. He has worked for major banks, insurance companies, nonprofits, and families too. He is also an author, pastor, Special Ed Teacher, and financial blogger and holds a doctorate in Stewardship.